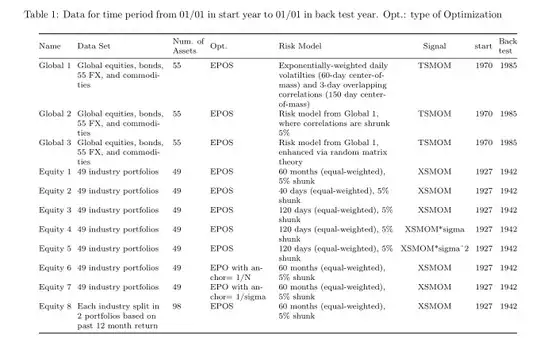

I would like to remove the space between words when the text is wrapped in columns 2,4 and 5.

Then I want to adjust the text alignment of the last 3 columns to right.

Lastly if I can wrap the 3th column tile would be great.

\begin{table}[H]

\centering

\begin{adjustbox}{max width=1\textwidth,center}

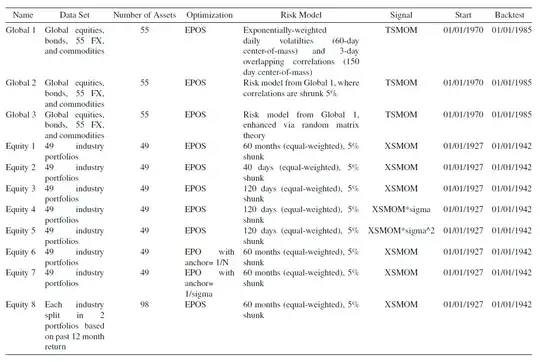

\begin{tabular}{@{}l p{0.18\linewidth} c p{0.15\linewidth} p{0.35\linewidth} c r r @{}}

\toprule

\multicolumn{1}{c}{Name} & \multicolumn{1}{c}{Data Set} & Number of Assets & \multicolumn{1}{c}{Optimization} & \multicolumn{1}{c}{Risk Model} & Signal & \multicolumn{1}{c}{Start} & \multicolumn{1}{c}{Backtest} \\ \midrule

Global 1 & Global equities, bonds, 55 FX, and commodities & 55 & EPOS & Exponentially-weighted daily volatilties (60-day center-of-mass) and 3-day overlapping correlations (150 day center-of-mass) & TSMOM & 01/01/1970 & 01/01/1985 \\

Global 2 & Global equities, bonds, 55 FX, and commodities & 55 & EPOS & Risk model from Global 1, where correlations are shrunk 5\% & TSMOM & 01/01/1970 & 01/01/1985 \\

Global 3 & Global equities, bonds, 55 FX, and commodities & 55 & EPOS & Risk model from Global 1, enhanced via random matrix theory & TSMOM & 01/01/1970 & 01/01/1985 \\

Equity 1 & 49 industry portfolios & 49 & EPOS & 60 months (equal-weighted), 5\% shunk & XSMOM & 01/01/1927 & 01/01/1942 \\

Equity 2 & 49 industry portfolios & 49 & EPOS & 40 days (equal-weighted), 5\% shunk & XSMOM & 01/01/1927 & 01/01/1942 \\

Equity 3 & 49 industry portfolios & 49 & EPOS & 120 days (equal-weighted), 5\% shunk & XSMOM & 01/01/1927 & 01/01/1942 \\

Equity 4 & 49 industry portfolios & 49 & EPOS & 120 days (equal-weighted), 5\% shunk & XSMOM*sigma & 01/01/1927 & 01/01/1942 \\

Equity 5 & 49 industry portfolios & 49 & EPOS & 120 days (equal-weighted), 5\% shunk & XSMOM*sigma\textasciicircum{}2 & 01/01/1927 & 01/01/1942 \\

Equity 6 & 49 industry portfolios & 49 & EPO with anchor= 1/N & 60 months (equal-weighted), 5\% shunk & XSMOM & 01/01/1927 & 01/01/1942 \\

Equity 7 & 49 industry portfolios & 49 & EPO with anchor= 1/sigma & 60 months (equal-weighted), 5\% shunk & XSMOM & 01/01/1927 & 01/01/1942 \\

Equity 8 & Each industry split in 2 portfolios based on past 12 month return & 98 & EPOS & 60 months (equal-weighted), 5\% shunk & XSMOM & 01/01/1927 & 01/01/1942 \\ \bottomrule

\end{tabular}

\end{adjustbox}

\caption{}

\label{tab:my-table}

\end{table}

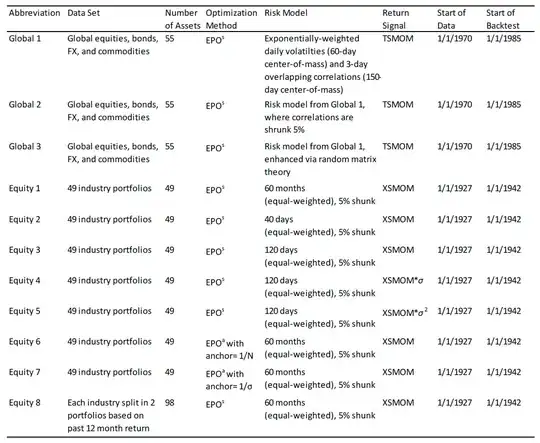

Basically I want to replicate this next table