I'm looking to include a table in a document on a single page with A4 size, ensuring that the text remains readable. I attempted to use \scalebox, but it resulted in the text becoming too small and altering the width and height of the box. Since I'm relatively new to LaTeX, I find myself a bit stuck and would appreciate any suggestions or guidance you could offer on how to achieve this. Thank you!

\tiny

\begin{table}[!htbp] \centering

\begin{adjustbox}{width=\textwidth}

\begin{tabular}{@{\extracolsep{0pt}} llllllllllllllllllllllllllllllllllllllllll}

\\[-1.8ex]\hline

\hline \\[-1.8ex]

\textbf{Monetary Policy} \\

1) Monetary Authority Loans Through the Asset Backed Commercial Paper Money \\ Market Mutual Fund Liquidity Facility AMLF and Money Market Mutual Fund \\ Liquidity Facility MMLF Asset Level Lag 1 \\

2) Monetary Authority Depository Institution Loans N E C to Other Financial Business \\ Commercial Paper Funding Facility LLC Asset Transactions Lag 1 \\

\textbf{International Finance - Government} \

- Rest of the World U S Government Loans Excluding Capital Subscriptions and \ Contributions to International Financial Institutions and the IMF Liability Revaluation Lag 0 \

- Rest of the World Other U S Reserve Assets Other Claims Liability Transactions Lag 0 \

- Rest of the World U S Government Loans Excluding Capital Subscriptions and \ Contributions to International Financial Institutions and the IMF Liability Revaluation Lag 1 \

- Rest of the World U S Government Loans Excluding Capital Subscriptions and \ Contributions to International Financial Institutions and the IMF Liability Revaluation Lag 4 \

- Rest of the World Other U S Reserve Assets Other Claims Liability Revaluation Lag 0 \

\textbf{Domestic Finance - Private} \

- Government Sponsored Enterprises Equity Capital of Farm Credit System Transactions Lag 3 \

- Pension Funds Corporate Equities Asset Transactions Lag 2 \

- Security Brokers and Dealers Payables to Customer and Rest of the World \ Noncustomers Free Credit Margin Deposits and Other Payables Liability \ Transactions Lag 4 \

- Government Sponsored Enterprises Corporate Equities Held by Freddie Mac Asset \ Level Lag 0 \

- Private Depository Institutions Total Time and Savings Deposits Liability \ Transactions Lag 1 \

- Nonprofit Organizations Municipal Securities Sum of Holders Liability FWTW \ Transactions Lag 4 \

- Other Financial Corporations and Insurance Companies and Pension Funds Net \ Claims on Nonfinancial Businesses and Households and Nonprofit Organizations \ Asset FWTW Transactions Lag 4 \

\textbf{Recession} \

- Government Sponsored Enterprises Equity Capital of Farm Credit System Transactions Lag 4 \

- NBER based Recession Indicators for the United States from the Period following \ the Peak through the Trough Lag 2 \

- NBER based Recession Indicators for the United States from the Peak through the \ Period preceding the Trough Lag 3 \

- OECD based Recession Indicators for the United States from the Peak through the \ Trough Lag 2 \

- OECD based Recession Indicators for the United States from the Peak through the Trough 1 Lag 2 \

\textbf{Unemployment and Wages} \

- Employment Level Agriculture and Related Industries Wage and Salary Workers Lag 1 \

- Unemployment Rate Nonagriculture Private Wage and Salary Workers Lag 3 \

\textbf{Domestic Finance - Government} \

- State and Local Government Employee Defined Benefit Retirement Funds Total Time \ and Savings Deposits Asset Transactions Lag 0 \

- State and Local Government Employee Defined Benefit Retirement Funds Total Time \ and Savings Deposits Asset Transactions Lag 1 \

- Total Consumer Credit Owned by Depository Institutions Flow Lag 1 \

- Domestic Financial Sectors Net Saving Including Foreign Earnings Retained Abroad \ and CCAdj Less Net Capital Transfers Paid Other Than for Financial Stabilization \ Program Transactions Lag 1 \

- General Government Other Accounts Payable Including SDR Allocations Liability \ IMA Revaluation Lag 4 \

- State and Local Governments Foreign Bonds Asset FWTW Transactions Lag 2 \

- Domestic Financial Sectors Net Saving Including Foreign Earnings Retained Abroad \ and CCAdj Less Net Capital Transfers Paid Other Than for Financial Stabilization \ Program Transactions Lag 2 \

\textbf{International Finance - Private} \

- Households and Nonprofit Organizations Commercial and Multifamily Residential \ Mortgages Asset Transactions Lag 1 \

- Rest of the World Corporate Bonds Issued by Netherlands Antillean Financial \ Subsidiaries of U S Corporations Asset Revaluation Lag 4 \

- Households and Nonprofit Organizations Commercial and Multifamily Residential \ Mortgages Asset Transactions Lag 2 \

- Pension Funds Security Repurchase Agreements Issued by the Rest of the World \ Asset FWTW Revaluation Lag 4 \

- Domestic Financial Sectors Insurance Pension and Standardized Guarantee Schemes \ Asset IMA Revaluation Lag 4 \

- Rest of the World Debt Securities and Negotiable Certificates of Deposit Issued \ by Financial Corporations Asset FWTW Transactions Lag 1 \

- Private Pension Funds Security Repurchase Agreements Asset Transactions Lag 3 \

- Private Pension Funds Security Repurchase Agreements Asset Transactions Lag 2 \

- Holding Companies Security Repurchase Agreements Issued by the Rest of the World \ Asset FWTW Transactions Lag 0 \

- Rest of the World Corporate Bonds Issued by Netherlands Antillean Financial \ Subsidiaries of U S Corporations Asset Transactions Lag 0 \

\textbf{Housing and Mortgages} \

- Federal Government One to Four Family Residential Mortgages Held by RTC Asset \ Level Lag 1 \

- Federal Government One to Four Family Residential Mortgages Asset Transactions \ Lag 4 \

- Federal Government One to Four Family Residential Mortgages Held by Public Housing \ Administration PHA Asset Transactions Lag 4 \

- Federal Government One to Four Family Residential Mortgages Held by RTC Asset \ Level Lag 3 \

\hline \[-1.8ex]

\end{tabular}

\end{adjustbox}

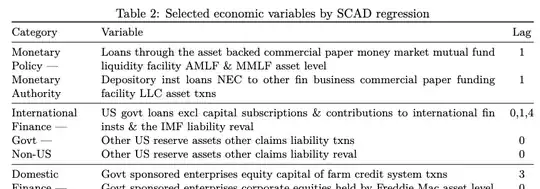

\caption{Selected economic variables by SCAD regression}

\end{table}

lcolumns if you only use one? Why do you use atabularat all? Anyways, the simplest hot fix to this would probably be to replace the column defintion (in the mandatory argument to thetabularenvironment) with just@{} p{\linewidth} @{}. – Jasper Habicht Feb 06 '24 at 17:13\scaleboxon tables as a last resort, and even then try to avoid it. – David Carlisle Feb 06 '24 at 17:35llllllllllllllllllllllllllllllllllllllllllmeans you are specifying a table of 41 columns, each set to the natural width of the text, with no line breaking. That is not going to fit in most pages. – David Carlisle Feb 06 '24 at 17:36\begin{table}[!htbp] \centering \begin{adjustbox}{width=\textwidth} \small \begin{tabular}{@{\extracolsep{0pt}} l} \[-1.8ex]\hline

\hline \[-1.8ex] \textbf{Monetary Policy} \

- Monetary Authority Loans Through the Asset Backed Commercial Paper Money \ Market Mutual Fund Liquidity Facility AMLF and Money Market Mutual Fund \ -......

– Joe94 Feb 06 '24 at 18:07enumerateenviornments – David Carlisle Feb 06 '24 at 18:41lcolumn, but ap{\linewidth}column which will automatically break lines. You can additionally decrease the font size with\smallor\footnotesize. If the text body is not very tight, this should work. If not, please show a minimal working example (MWE) so that we know more about your document set up, the paper size, margins etc. – Jasper Habicht Feb 07 '24 at 08:22